February 5, 2020

What’s Hot (& Cold) in HVAC Systems

A decade ago, most predicted that rising energy costs and more stringent energy efficiency regulations would spell the doom of all-electric heating systems while sparking the market for natural gas and geothermal heating systems. Things haven’t gone as predicted. Why? First, modest energy prices have prevailed, and heating loads for homes has declined dramatically due to improved efficiency of the building envelope. Second, single-family homes are actually getting smaller and they’re more likely to be one-level than two or more. Third, there’s been a surge in “exurb” development, neighborhoods being built outlying large metropolitan areas, away from the city and often without access to piped gas.

Source: Annual Builder Practices Survey, Home Innovation Research Labs

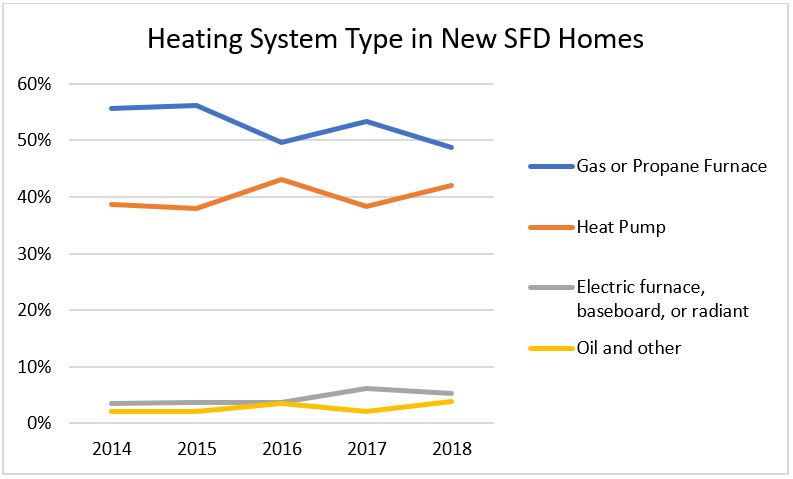

Home Innovation Research Labs conducts the Builder Practices Survey annually, and from that Survey we publish our “HVAC Systems in New Homes” report (among others). Assessing a discreet market like this year over year, we uncover a lot of interesting shifts. As the graph above illustrates, gas furnaces are showing a modest decline over the past four years, and heat pumps seem to be growing slightly along with electric-resistance and other alternatives.

Electric resistance heating is historically down over the past few decades. However, our Builder Practices Survey data shows its market share heating up slightly in the past few years to about 6% of new single-family detached homes using it as the primary heating source. With building envelope improvements in housing over the past few years, heating loads are declining, keeping electric resistance a cost-effective option for some areas of the country.

Another new industry “norm” is also affecting HVAC selection in ways we haven’t seen before. Home affordability is on the decline, owing largely to the increased cost of building a new home. As the construction labor shortage worsens, builders report continuing increases in costs for subcontracted labor and materials, putting pressures on the bottom line. The result? Pressure to install systems with lower initial costs in new homes, such as traditional split-system heat pumps and electric resistance heating. By installing all-electric heat pumps, for example, builders avoid the gas hook-up fee, the cost for running a gas line from the curb to the house, and eliminate the need to include gas lines and account for exhausting combustion gases throughout the home. This is particularly compelling as efficiencies of heat pumps continue to increase, making them a viable choice for cooler climates.

Source: Annual Builder Practices Survey, Home Innovation Research Labs

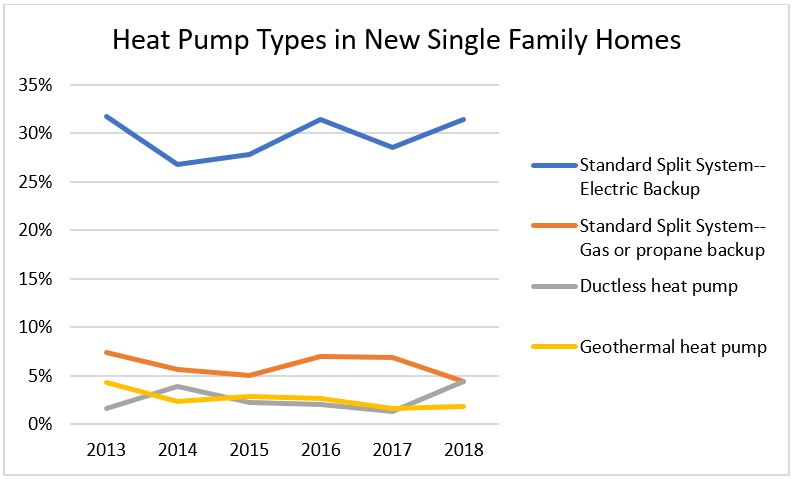

Among heat pumps installed, the Builder Practices Report reveals that Electric Backup systems are on a growth pattern while Gas Backup systems are trending fairly flat. Ductless Heat Pumps, while long popular in HVAC retrofits, are just now beginning to capture share in new homes. And Geothermal systems, while very quiet and efficient, have lost share in the past few years—likely due to higher initial cost.

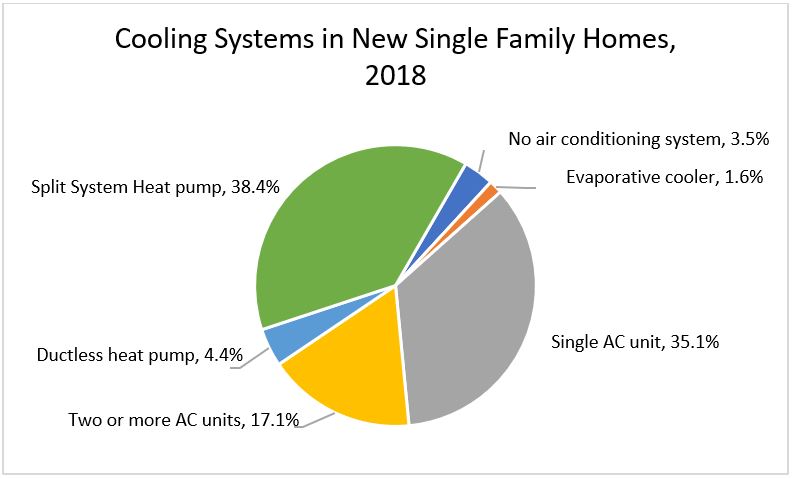

With air conditioning, single AC unit systems are regaining popularity over using two or more AC units in a new home. There are a few key reasons for this: 1) the increased popularity of mini-splits with multi-zones; 2) the decline in the share of two-story new homes; and 3) a decline in the average size of new homes combined with reduced cooling loads due to a more efficient thermal envelope, making dual AC units too large to efficiently cool the home.

Source: Annual Builder Practices Survey, Home Innovation Research Labs

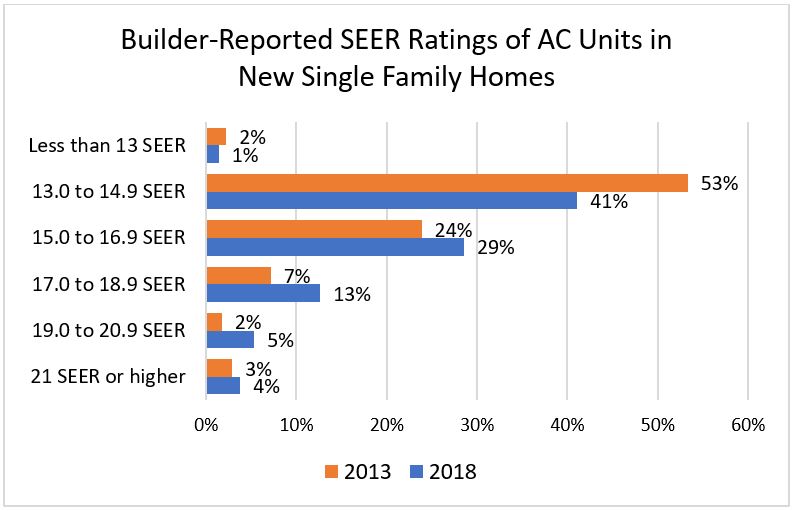

Builders are reporting a big increase in more energy efficient systems as well—not just from increasing energy efficiency regulations for HVAC equipment, but also due to above-code, ultra-high efficiency AC systems. For example, 22% of homes built in 2018 had 17 SEER systems compared to 12% just 5 years earlier.

Source: Annual Builder Practices Survey, Home Innovation Research Labs

The HVAC report is just one of many building product categories we track through the Annual Builder Practices Survey, including:

Appliances | Bathroom Accessories | Beams & Headers | Cabinets

Countertops | Deck & Porch Railings | Ducts | Exterior Doors | Faucets

Fencing & Landscape Walls | Fire Sprinklers | Finish Flooring | Foundations

Garage Doors | Home Electronics | Home Mechanical Ventilation

Standby Generators | House Wrap & Radiant Barriers | HVAC Systems

Infrastructure | Insulation | Interior Doors | Interior Finish Materials | Lighting

Outdoor Structures | Patio Doors | Plumbing Fixtures | Plumbing Piping

Roofing | Roofing Underlayment | Sheathing - Floor, Roof, Wall

Siding & Exterior Finish | Soffit, Fascia, & Exterior Trim

Structural Systems - Floor, Roof, Wall | Swimming Pools | Underlayment

Vapor Retarders in Walls & Ceilings | Windows

If you’re new to our annual reports – either Builder or Consumer Practices – you should know they are far more than just summary tabulations of a national survey of home builders. We employ a robust market demand modeling methodology that compiles volume and type of products and materials purchased. We report market demand for single- and multifamily properties separately.

We also provide more options than ever in data format. Our large survey sample size allows data subscribers to get a very granular look into county, metro area, state, and regional markets for new home products purchases. This year, the Builder Practices Reports will be available in both tabular and database formats that give our clients more analysis options, including analysis via business analytics and mapping software.

If you’d like to see how other market segments are heating up or cooling down, get in touch! Contact Ed Hudson, Home Innovation’s director of market research, online or by calling 301.430.6305.

Back to Top