Ed Hudson, MBA

June 30, 2020

Do I Hear an Echo?

The 1970’s was the greatest home building decade in U.S. history in terms of the total number of new homes built—nearly 18 million residences in that decade. Fueled by the Baby Boom generation’s need for housing, there was a rental housing boom in the early 70’s, followed by a very strong starter home market, and later as the Baby Boom generation continued to move through its life cycle, began buying move-up homes like they did starter homes a decade earlier.

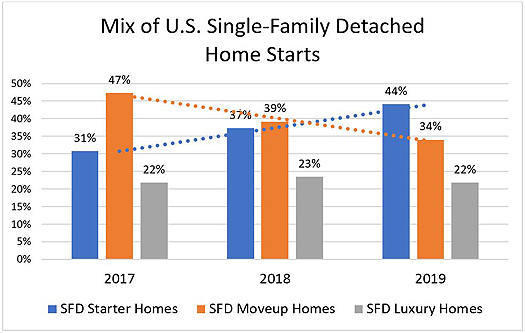

And now, the children of Boomers, called the Baby Boom Echo Generation, or “Millennials,” are the largest home-buying cohort in our current housing market, and it’s beginning to look like a re-run from their parent’s generation. The cyclical peak for multifamily rental construction occurred in 2015. With the apartment boom now leveling off and Echo Boomers transitioning into home ownership, the single-family starter home is seeing a robust return.

Source: Home Innovation Research Labs' Annual Builder Practices Survey

Unlike the apartment boom, which was centered in urban and high density suburban areas, the single-family housing boom is happening in the lower-density suburbs and outlying areas, and Millennials are the ones driving this shift—just like their parent’s generation housing choices fueled sprawl in the 80’s and 90’s (because that’s where the affordable homes were).

THE NEW HOUSING MARKET: CULTURE CHANGE, OR SIMPLY DEMOGRAPHICS?

Contrary to what many have predicted, the Millennial generation may NOT be a totally new tribe with a culture and housing preferences unlike any other generation. The majority DO aspire to own homes like preceding generations—as soon as they can afford it and as soon as it suits their life stage. If I had doubts about this, our current COVID-19 crisis has erased them by reviving a sense in our population that “home is where the heart is” and not just a resting place between the social activities and the workplace (a trait sometimes ascribed to Millennials).

SNEAK PEEK INTO THE 2020 BUILDER PRACTICES SURVEY FINDINGS

The Builder Practices Survey has been documenting changes in new home features and materials for more than 25 years, and the 2020 Survey sheds additional light on our new starter-home dominated market. The findings caution us against presuming that this market dominated by affordable homes will across-the-board favor low-end materials. For example, in the past year…

- The finished floor area of Starter homes continues to climb—from 1,675 to 1,735 square feet

- Granite continues to lead the kitchen countertop market with 50% of the kitchen countertop market, but quartz saw impressive growth from about 17% to 26% share. Less expensive options like laminate and solid surfacing saw shares drop

- Wood and composite windows are up, and the traditionally less expensive options of vinyl and aluminum are down

- Fiberglass share of the new home entry door market grew to almost 50%, while lower-cost steel doors declined

- Concrete tiles and metal roofing became increasingly popular, while asphalt shingles saw a modest decline in share

- Brick exteriors saw a big jump after a decades-long slide

However, some product categories associated with entry-level homes grew at the at the expense of higher end materials, such as…

- Resilient flooring—particularly LVT—grew rapidly while solid wood flooring shares dipped

- Vinyl siding saw a modest gain this past year, reversing a longer-term trend

- Share of concrete materials (poured and pavers) is up for Patios and Porches, and the higher cost alternatives of clay brick and natural stone are down

- Hinged patio door share drops sharply to about 1/3, while sliders now represent about 2/3 of this market

- PE-RT plumbing piping experiences a growth “spurt” as a lower-cost plumbing option

This is just a glimpse of the findings of our 2020 Builder Practices Survey. Top building product manufacturers have used Home Innovation's survey data for over 25 years to determine market demand and identify trends like these in the building materials market. 2020 Builder Practices Reports will be available in the coming weeks. Contact us immediately to learn about how you can be among the first to explore your specific product categories in this quickly evolving market.

The Builder Practices Reports cover building products installed on new homes and can be paired with our annual Consumer Practices Reports to give you a complete view of the residential building materials market. Builder Practices Reports span the following categories:

Appliances | Attic Access | Bathroom Accessories & Shower Doors

Beams | Cabinets for Kitchen & Bath | Cement Usage | Countertops

Deck & Porch Railings | Driveways | Ducts | Exterior Doors | Faucets

Fences & Landscape Walls | Finish Flooring | Fire Sprinkler Systems

Foundations | Garage Doors | Headers | Home Electronics

Home Mechanical Ventilation | Home Standby Generators

House Wrap & Radiant Barriers | HVAC Systems | Insulation

Infrastructure | Insulation | Interior Doors | Interior Finish Materials

Lighting | New Housing Characteristics | Outdoor Structures

Patio Doors | Plumbing Fixtures | Plumbing Piping

Radiant Floor Heating | Roofing | Roofing Underlayment

Sheathing - Floor | Sheathing - Roofs | Sheathing - Walls

Siding or Exterior Finish | Soffit, Fascia & Exterior Trim

Structural Systems - Floor | Structural Systems - Roofs

Structural Systems - Walls | Swimming Pools | Underlayment

Vapor Retarders in Walls & Ceilings | Windows

We also provide more options now in data format than we ever have before. The large survey sample size allows data subscribers to get a very granular look into county, metro area, state, and regional markets for new construction. This year, Builder Practices Reports are available in both tabular and database formats that give you more analysis options, including analysis via business analytics and mapping software like Power BI and Tableau. Interested in getting the details on your product categories? Get in touch to learn more about how you can better monitor the market for construction products with this report series.

Back to Top