Ed Hudson, MBA

June 10, 2020

The Great Outdoors: Trends from 2020 Consumer Practices Survey

For the past several years, Outdoor Living upgrades have been getting a lot more attention as homeowners seek to expand their living space from within the walls of the home to beyond those borders. Average new home size has shrunk in the past few years, but the expansion of outdoor living space has more than filled the gap the shrinking home has left.

This shift of focus to outdoor living mostly reflects a lifestyle change, and with it a change in preferences in materials purchases—amount of materials, and types. Now, with social distancing norms keeping us away from public spaces at the same time the weather is getting warmer, consumers are again focusing on how to improve their at-home living experience and expand the space in which they do it.

Source: Home Innovation Research Labs' Annual Consumer Practices Survey

The 2020 Consumer Practice Survey covers more than 30 categories of home remodeling activities. For example, our Outdoor Structures Report tracks materials purchased for decks, patios, walkways, porches, docks, and piers. Among materials chosen for patios, walkways, and porches, Clay Brick Pavers and Tiles made the biggest gains, primarily against Concrete Pavers. Average deck size remained the same in 2019 — about 300 square feet on average — and, despite being down 7 percentage points from the previous year, Treated Lumber is still the most popular decking surface material (45%). Picking up Treated Lumber’s lost share on decks were Redwood and Cedar – naturally rot-resistant woods — gaining from 19% to 25% year-over-year. Composite & PVC shares rose modestly, gaining one percentage point to about 20%.

In our Deck and Porch Railings Report, Redwood and Cedar made major gains against Treated Woods and took some of the steam out of the recent market growth in Composites and Metal systems. This likely reflects a popularity of railing systems that are factory-made and assembled on-site over completely site-built railing from materials purchased locally. Upscale Glass Panel and Steel Cable railing systems remained at about 3.5% combined.

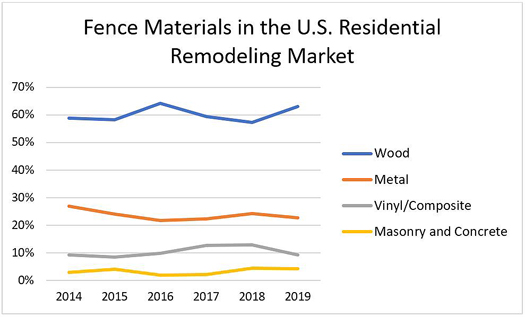

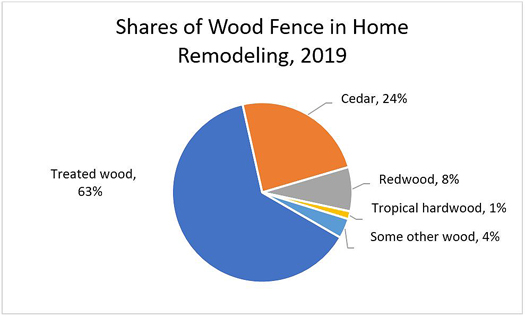

The Fences and Landscape Walls Report reveals that the number of homes spending on fences in 2019 grew by 9% over 2018 — indicating privacy is gaining popularity in outdoor living design. The most popular type reported was a privacy fence with treated wood boards on one side (33%), followed by a privacy fence with wood boards alternating on both sides (20%). Wood fences (all types) represent about 65% of the market, gaining ground in 2019 and taking share from Polymer and Metal.

Source: Home Innovation Research Labs' Annual Consumer Practices Survey

Our Other Outdoor Structures Report covers Pergolas, Arbors, Benches, Planters, Privacy Screens, and Trellises. Overall, Redwood and Tropical Hardwoods saw the greatest gains for these outdoor structures, while Treated Lumber showed the biggest drop. The growth in these categories reflects an increased share of factory-made, site-assembled products from domestic and overseas manufacturers.

This is just a glimpse of the interesting findings from our 2020 remodeling survey. Top building product manufacturers have used Home Innovation's survey data for over 20 years to determine market demand and identify trends like these in the building materials market. 2020 Consumer Practices Reports are now available. Contact us now to learn about how you can be among the first to explore your specific product categories in this fast-evolving market.

The Consumer Practices Reports cover building products used in residential repair and remodeling and can be paired with our annual Builder Practices Reports to give you a complete view of the residential construction market. Consumer Practices reports are available in the following categories:

Appliances | Cabinets for Kitchen & Bath | Countertops

Deck & Porch Railings | Exterior Doors | Faucets

Fencing & Landscape Walls | Finished Flooring | Garage Doors

Home Mechanical Ventilation | Home Standby Generators

House Wrap & Foam under Siding | Insulation | Interior Doors

Interior Finish Materials | Outdoor Structures - Decks, Patios & Porches

Patio Doors | Plumbing Fixtures | Plumbing Piping | Roofing

Roofing Underlayment | Sheathing - Floor, Roof & Wall

Siding & Exterior Cladding | Soffit, Fascia & Exterior Trim

Storage Systems for Closet & Garage

Structural Systems - Floor, Roof & Wall | Windows

What Makes Home Innovation’s Consumer Practices Reports Better?

Our reports are far more than just summary tabulations of a national household remodeling survey. We employ a robust market demand modeling methodology that compiles volume and type of products and materials purchased. Our Consumer Practices Reports also distinguish between owner- and renter-occupied households, places of purchase, DIY vs. Pro installations, and many more important details.

We also provide more options now in data format than we ever have before. The large survey sample size allows data subscribers to get a very granular look into county, metro area, state, and regional markets for residential remodeling. This year, our Consumer Practices Reports are available in both tabular and database formats that give you more analysis options, including analysis via business analytics and mapping software like Power BI and Tableau. Interested in getting the details on your product categories? Get in touch to learn more about how you can better monitor the market for construction products with this report series.

Back to Top