Labor and supply chain issues have shaped the industry in recent years, particularly since the COVID pandemic. The net result has been longer construction cycle times, rising construction costs, and simply a much more difficult environment for building and remodeling homes. Our recent 2022 Builder Practices Survey sheds more light on how builder choices of home features, products, and materials has changed in response to these market conditions.

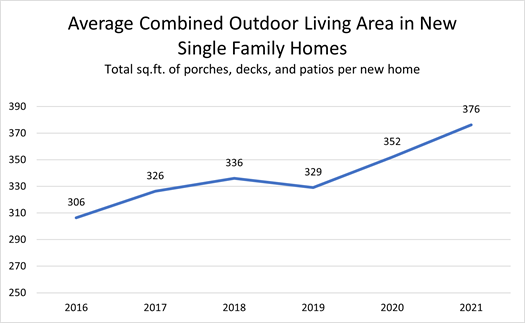

In some cases, the pandemic accelerated trends — for example, the graph below shows the greatly expanding outdoor living areas delivered with new homes. In other cases, trends have reversed, and some builders have begun adopting new products and materials, or going back to old standbys, when high prices and lack of availability have slowed their building process down.

Source: Home Innovation Research Labs’

Annual Builder Practices Survey

Last year, when reviewing the 2021 Builder Practices Report data, I expected to see some stark reactions to skyrocketing prices of lumber and wood panels and shortages. Instead, it seemed like the industry response was to “hunker down” and accept delays and price hikes as part of the new operating environment; I didn’t see a lot of product substitutions taking place. This year, however, we’re seeing evidence that builders are making changes in product choices in some building maerials categories to mitigate pricing and availability challenges.

Sheathing Materials

During the first year of the pandemic, builders generally continued using plywood and OSB despite the higher cost. Many builders did choose, however, to use plywood rather than OSB. From 2020 to 2021, plywood shares of subflooring grew from 32% to 45% of sheathing panels, and in roofs it grew from 30% to 36% of the market.

The switch from plywood and OSB to other sheathing panels gained momentum in 2021, where insulating fiber board sheathing varieties — think Celotex and Thermo-ply types — and foam board gained ground. Further, builders who were previously using double layers of wall sheathing – OSB + foam board – to satisfy structural and thermal requirements, began to eliminate the wood structural panel and use foam board only, incorporating alternative bracing methods to meet building codes.

Framing Materials

For framing materials, the market shifted in 2021 to use more regionally-produced materials, particularly with lumber. Historically, Spruce-Pine-Fir (SPF) lumber from the Northeast and Canada has been the most popular wall stud material in new U.S. homes, even in the South where Southern Yellow Pine (SYP) is grown and plentiful. However, since the pandemic, SYP has become the most popular wall stud species reported by home builders, and Douglas Fir and Western woods have gained share as well. In 2021, SYP grew from 26% to 34% nationally – that would have been unimaginable a few years ago. In lumber floor joists, SYP also gained in 2021 over the previous year – from 37% to 45% of lumber installed in the structural flooring of new homes.

Ongoing supply chain issues have created delays in the supply of building components such as roof trusses and wall panels. In 2021, some builders responded to the extended delivery schedules by reverting back to stick framing. This led to roof truss and wall panel shares of the new home market bucking their growth trend and falling back to levels not seen in a decade.

Quick- / Easy-to-Install Alternatives

As the shortage of skilled construction workers worsened during the pandemic, building materials that promised installation in fewer steps, or installation by lower-skilled workers, rapidly gained popularity. For example, in 2021, tile and solid hardwood floors lost market share while luxury vinyl plank and tile and engineered wood flooring continued their rise. Tiled shower and bath surrounds also took a tumble, while manufactured units and solid stone and polymer panel surrounds gained popularity.

Other Material Substitutions in 2021

We’ve heard anecdotal reports from builders that the short supply issues were most acute with builder-grade products, and substitutions tended to be for higher-grade products. This, in turn, added to the increasing cost of building homes. The 2021 BPS data bears these reports out in a few product categories. For example, hollow-core interior door shortages resulted in a shift to buying more solid core doors. Builders substituted acrylic bathing fixtures for gel-coated fiberglass fixtures. And raised-panel sectional steel garage doors lost some share to side-hinged, flat panel wood doors.

One notable exception to the general 2021 trend of upward substitutions was seen in front entry door systems. Fiberglass front entry door systems saw a substantial drop in market share – from 54% to 44% year over year – with steel door systems primarily taking up most of the slack and a modest uptick in share for wood doors.

These are just a few of the highlights of the market changes we tracked during our second year into the pandemic; other product categories saw changes as well. Below is a list of our Builder Practices Report categories for 2022:

|

|

If you want to fully understand market demand for your product or material category, how it fared in 2021, and how to thrive in the current market, you need the 2022 Builder Practices Report. Contact us today to purchase your reports.