In recent years, a great deal of emphasis has been placed on the skilled labor shortage affecting construction and the related changes in building and buying patterns this has caused among home builders. But there may be an even greater pain-point among builders that’s getting a lot less attention—builder sensitivity to increases in building materials prices. Given the nature of the construction business, price increases over the course of home construction (currently averaging 7 months from breaking ground to completion) cuts into margins, while price declines are a windfall. The problem is that lately price increases have far outweighed decreases.

In the period of June 2017 to 2018, the U.S. Census reported a phenomenal 8.8% year-over-year increase in the Producers Price Index (PPI) for construction products. Lumber, gypsum, and concrete are major components of this index. Not surprisingly, in a survey conducted by Home Innovation in late 2018, builders told us the number one difficulty arising from energy code changes was the resulting increase in construction costs.

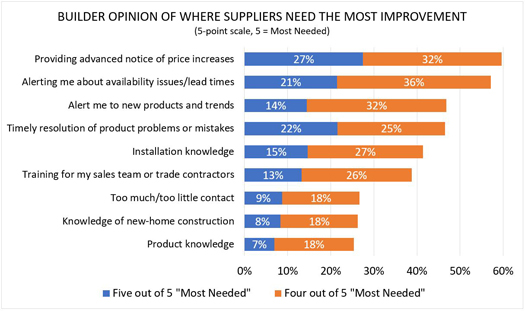

The PPI for construction products from June 2018 to June 2019 revealed a decline of about 1.6%. That provided builders some relief, but not enough to de-sensitize them to materials price increases. Builders’ continued sensitivity toward price increase has been confirmed by a recent survey conducted by Professional Builder magazine. When asked how their suppliers could improve, builders rated the most needed improvement as notification of price increases—placing it higher than alerts on product availability, delivery lead times, and resolution of problems and mistakes.

Source: Professional Builder 2019 Supply Chain Study

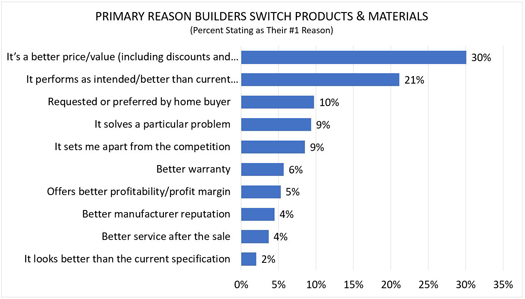

In the same Professional Builder study, when asked why they switched building products within the same category, respondents said their biggest motivation was to get a better price or value over the current product specification—ranking higher than improved performance or homebuyer request or preference.

Source: Professional Builder 2019 Supply Chain Study

What does this mean to the supply side of home construction? It indicates that a substantial number of builders still view many building materials as commodities, where any one is a substitute for another. Many manufacturers have found that selling products purely on the promise of increased performance, durability, or functionality does not guarantee acceptance by builders. Cost is rarely the sole factor, but it is virtually always part of the picture. It’s important to determine for each product category whether builders value superior performance, or whether they have a minimum threshold of performance expected and are seeking the lowest-priced product that satisfies their need.

The best way to determine which side of the scale your product falls on is to ask your customers. Home Innovation regularly helps manufacturers and suppliers evaluate their markets and market opportunities through focus groups, interviews, and surveys of builders, remodelers, suppliers, and trade contractors. To find out how we can help you gain insight into the market for your building products, contact me.

***